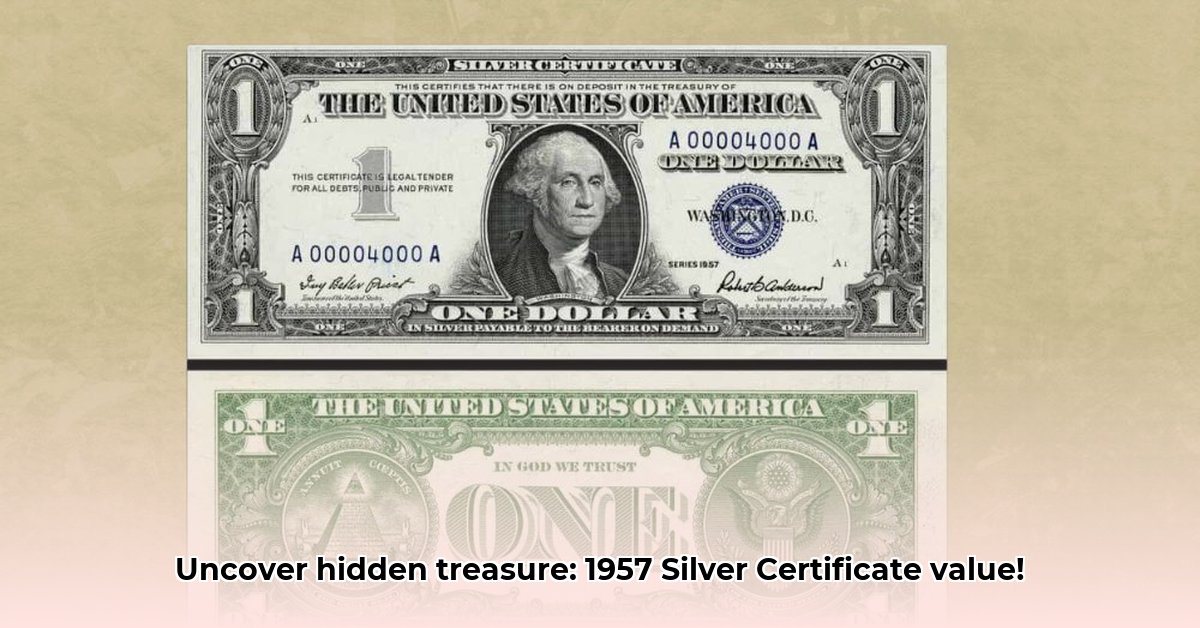

The 1957 $1 Silver Certificate, with its iconic blue seal, represents a fascinating intersection of history and numismatics. While billions were printed, making individual notes not inherently rare, their value significantly varies based on condition, series, and the presence of errors. This guide provides collectors of all experience levels actionable advice for assessing and potentially profiting from this collectible currency.

Understanding the Value of a 1957 Silver Certificate

The value of a 1957 $1 Silver Certificate is far from uniform. Several key factors determine its worth:

Condition: The Primary Determinant

The most crucial factor influencing a 1957 Silver Certificate's value is its condition. A crisp, uncirculated note (UNC), meaning it's never been in circulation, commands a significantly higher price than a well-worn, circulated example. Professional grading services, such as those offered by the Professional Coin Grading Service (PCGS) and the Numismatic Guaranty Corporation (NGC), employ a precise grading scale (e.g., Extremely Fine 40, or XF40) to objectively assess a note's condition. A higher grade translates directly to a higher value. Did you know that a pristine note can be worth hundreds or even thousands of dollars more than a well-used one?

Series Variations: 1957, 1957A, and 1957B

Three distinct series exist: 1957, 1957A, and 1957B. These subtle differences in printing, often in the Treasury seal or signatures, affect a note's desirability and consequently, its value. Some series were printed in smaller quantities than others, leading to higher values for those rarer series.

Star Notes: A Mark of Replacement

Star notes, denoted by an asterisk (*) near the serial number, are replacements for damaged notes. While not automatically more valuable, their rarity can slightly increase their worth. These notes, often overlooked, can hold a small but pleasant surprise for collectors.

Printing Errors: Where the Real Treasure Lies

Printing errors, such as mismatched serial numbers, off-center printing, or other significant deviations from the standard design, can dramatically increase a note's value. These errors can fetch hundreds or even thousands of dollars. These errors are rare, and identifying them requires patience and a keen eye for detail. However, the rewards for finding these errors make the effort worthwhile.

Assessing Your 1957 Silver Certificate: A Step-by-Step Guide

To determine your 1957 Silver Certificate's worth, follow these steps:

Visual Inspection: Carefully examine the note for any creases, tears, stains, or general wear. Note the overall cleanliness and sharpness of the printing.

Series Identification: Look for the date and any letter (A, B) following the year, usually near the Treasury seal. This is crucial for determining the series and its relative rarity.

Error Detection: Scrutinize the note for any printing anomalies. This includes misalignments, double serial numbers, or other unusual features.

Professional Grading (Recommended): For the most accurate valuation, submit your note to a reputable grading service like PCGS or NGC. This provides an objective assessment and protects against overvaluation or undervaluation.

Market Research: Once graded, research similar notes online (using reputable sites) and in dealer catalogs to get an idea of current market value. Remember that values fluctuate.

Sourcing Your 1957 Silver Certificate

Several avenues exist for acquiring these historical notes:

Online Auctions: Platforms like eBay and specialized numismatic auction sites offer a vast selection. However, exercise caution and only buy from reputable sellers.

Coin Shops and Dealers: Local coin shops and online dealers provide expert advice and authentication services, minimizing the risk of purchasing counterfeits.

Estate Sales and Flea Markets: While more time-consuming, estate sales and flea markets occasionally yield hidden gems.

Is Investing in 1957 Silver Certificates a Smart Move?

Investing in 1957 Silver Certificates can be rewarding, but it requires careful consideration. Conduct thorough research, focus on high-grade notes, and understand that values fluctuate. Remember that this investment has inherent risks.

Approximate Value Ranges (USD)

| Condition | Value Range |

|---|---|

| Circulated | $1 - $5 |

| Very Fine (VF) | $5 - $20 |

| Extremely Fine (XF) | $20 - $100 |

| About Uncirculated (AU) | $100 - $500 |

| Uncirculated (UNC) | $500+ |

Disclaimer: These are rough estimates only. Actual value depends heavily on series, errors, and professional grading.

Key Takeaways

- The 1957 $1 Silver Certificate's value isn't solely determined by its age; condition, series, and errors significantly impact its worth.

- Professional grading is crucial for accurate valuation.

- Researching market trends and reputable sellers is essential for successful collecting.

- Investing in this market requires due diligence and an understanding of numismatic principles.

This guide provides a solid foundation for navigating the world of 1957 Silver Certificate collecting. Further exploration of specialized numismatic resources will enhance your understanding and collecting success.